Enterprise Risk Management

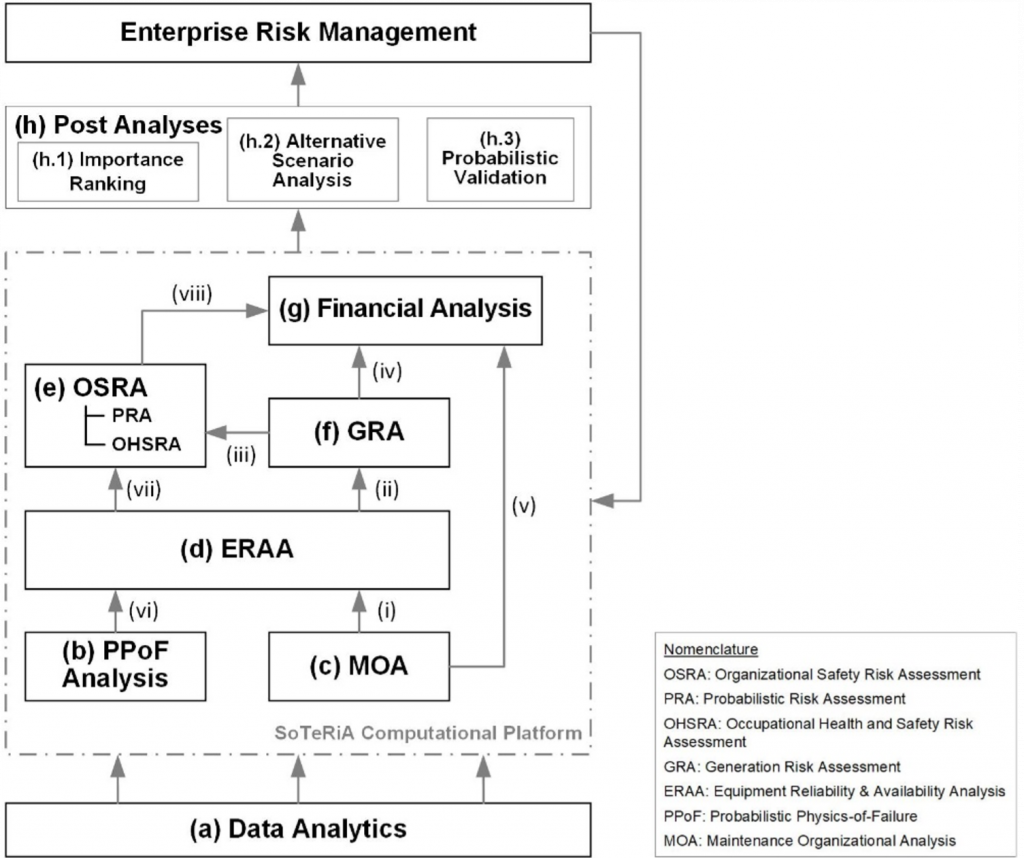

Increased competition and fluctuations in global markets necessitate a renewed focus on cost-saving initiatives and enterprise risk-management strategies. To remain economically competitive in the electric power market, operating nuclear power plants (NPPs) need to deploy innovative, cost-saving strategies while ensuring continued safe operation, as emphasized in the Nuclear Energy Institute (NEI) “Delivering the Nuclear Promise” initiative. The U.S. Department of Energy (DOE) awarded Professor Zahra Mohaghegh and her research team a three-year, $800,000 grant to enhance Enterprise Risk Management of NPPs. This research helps create a pathway that can enhance the economic viability of the operating NPPs. In the Integrated Enterprise Risk Management (I-ERM) framework [1] developed under this award, the underlying causations associated with maintenance performance (considering human and organizational factors) coupled with physical degradation mechanisms are explicitly modeled to depict the interconnections and dependencies between safety and financial performance [2, 3]. The outcome of this research will help NPP decision-makers create cost-saving maintenance strategies while maintaining safety by providing cost- and risk-informed recommendations regarding maintenance work processes and operational strategies. The methodologies developed in this project can also facilitate risk-informed design, licensing, operation, and maintenance of advanced reactors, supporting the goals of a carbon-free electric grid to reduce future climate change.

Fig. 1 Coupling PRA with financial risk in an Integrated Enterprise Risk Management methodological and computational platform, supported by the U.S. DOE (NEUP) under Award #17-12614.

Monetary Value of Risk Analysis: Industry-Academia Collaboration

The benefits of Probabilistic Risk Assessment (PRA) are not only experienced in terms of safety, but also from the monetary value derived from Risk-Informed Performance-Based Applications (RIPBAs), where risk estimated from PRA is utilized in decision-making to expand the safe operational envelope of plants, leading to either an increase in profits or a reduction in costs. The goal of this research is to provide a model-based approach (rather than a solely data-driven approach) to evaluate the monetary benefit of PRA by causal modeling of the net value of RIPBAs.

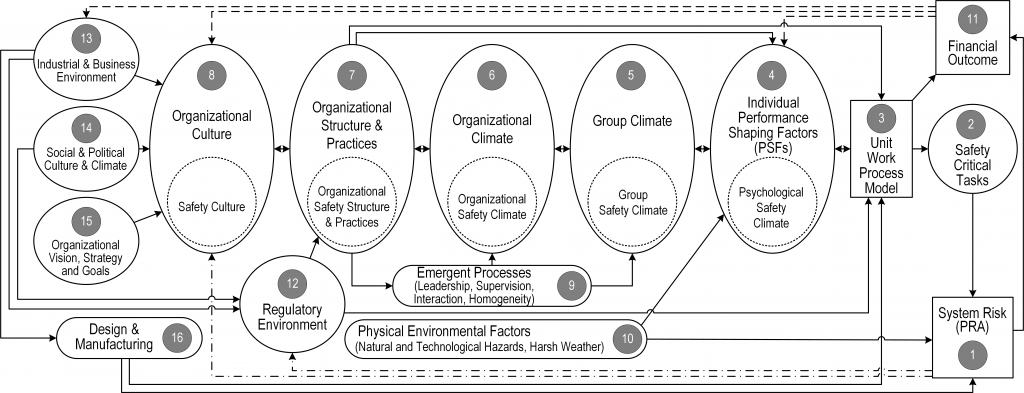

The SoTeRiA lab has been working with the South Texas Project Nuclear Operating Company (STPNOC) to advance research on the monetary value of PRA. At STPNOC, safety plays a crucial role in all activities, and risk has become a critical part in decision-making for all phases of operation and maintenance. STPNOC data is used to generate an integrated approach, combining aspects of benefit cost analysis and multi-attribute decision-making within the PRA framework. The methodology advances Risk-Informed Decision Making for high-consequence industries (i.e., nuclear, healthcare, aviation, oil and gas), by creating the opportunity to systematically model a course of action and to determine its monetary cost or benefit before a safety-significant change is made, or a problem occurs. The applications of this research will allow managers to consider multiple event sequences of socio-technical system failures, along with critical decision-making points that provide detailed systematic causal models of cost estimations.

Fig. 2 Socio-Technical Risk Analysis (SoTeRiA) framework [4].

References

- Mohaghegh, Z., et al. Systematic Enterprise Risk Management by Integrating the RISMC Toolkit and Cost-Benefit Analysis (Final Report), 2021. doi:10.2172/1817917.

- Beal, J., et al. Coupling Degradation and Maintenance to Model Safety Risk and Financial Risk under an Integrated Enterprise Risk Management for Nuclear Power Plants. in Proceedings of the 25th International Conference on Structural Mechanics in Reactor Technology (SMiRT-25). 2019. Charlotte, NC.

- Beal, J., et al. Integrated Enterprise Risk Management to Synchronize Safety and Profitability for Nuclear Power Plants. in American Nuclear Society Winter Meeting & Expo. 2020. Chicago, IL.

- Mohaghegh, Z. and A. Mosleh, Incorporating Organizational Factors into Probabilistic Risk Assessment of Complex Socio-Technical Systems: Principles and Theoretical Foundations. Safety Science, 2009. 47(8): p. 1139-1158.